This is the first article in a series exploring Toppers’ sustainable competitive advantage.

Growth oriented business investors study various industries and their segments for emerging growth opportunities. Even casual business observers recognize potential high growth (high risk) opportunities in emerging industries. Mammoth companies like Apple, McDonalds, Google and Ford were all early entrants in emerging industries at one time. Savvy business people seek to understand emerging consumer trends and needs and the companies that are best poised to exploit them.

3 of the largest pizza chains in the US today were born and flourished when pizza itself was an emerging industry. Pizza Hut, Dominos, and Little Caesars were all founded within two-years of 1960 – a great time to be a pizza entrepreneur. Today, the entire pizza market is estimated to be $40B. Those early restaurant companies who built the industry benefitted greatly from the tide rising for everyone.

It’s easy to believe that as overall industry revenues stabilize that high growth opportunities have been missed and only plodding, boring, yet less risky investments exist in that industry.

ENTER THE ASTUTE BUSINESS PERSON!

Very often competing companies that benefited early in the emergence of an industry profit fairly easily by simply exploiting the newfound opportunity and creating scale and operational efficiencies along the way. Best practices in the industry also emerge and all players benefit by chasing those same activities. This sustains those companies as the industry grows initially. Often though, this ability for several players to take a very similar path to success creates ultimately substantial homogeneity amongst the largest and earliest competitors in that industry. This sameness is exactly what gives rise to new competitors who exploit missed or emerging trends in the industry, and who stake out a distinct and sustainable strategic position from which to grow.

This is certainly true in the pizza business as the top 4 chains, who by some estimates account for more than 40% of the national pizza market, all offer essentially the same goods and services for the same prices. They have pursued every low cost frontier in a futile attempt to gain on their competitors who have pursued the very same activities. They have all raced to be the “best” low-cost provider of all things pizza to all people everywhere. Homogeneous. Cheap. Crap.

The pizza industry is estimated to be growing at a slow and stable 1% annually (which is still $400M!). BUT, the shift occurring inside our $40B industry is fascinating and well-studied by pizza/business geeks like me.

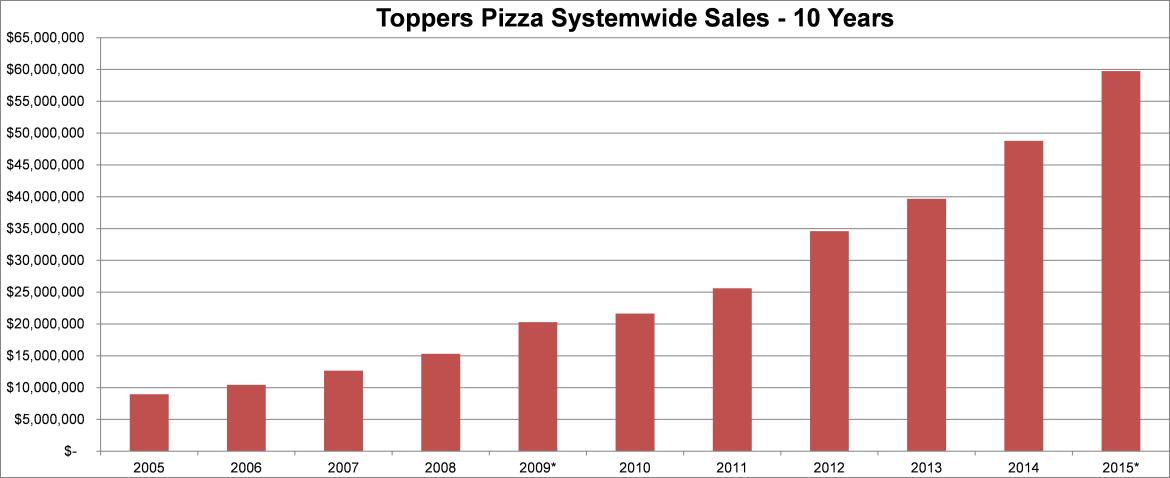

There are two major segments of the pizza business that are garnering substantial and sustainable growth today at the expense of others in the industry. There are hot, emerging and very profitable concepts, and there are failing and shrinking concepts and segments. Understanding that shift is key to understanding how Toppers has succeeded in growing 30% annually over the last 5 years in an industry that is by in large flat. It also explains why those of us who are all in on Toppers are so excited about our future.

Over the next few weeks I will explore these growing segments and trends in the pizza and restaurant business and how Toppers has created a sustainable competitive advantage by being positioned at their intersection.

Scott

2 comments

Comments are closed.